Crescent Energy Company (CRGY) is a prominent player in the energy sector, known for its innovative approach to oil and gas exploration and production. Crescent Energy Company is an independent oil and gas company with a focus on acquiring, developing, and operating oil and gas properties primarily in the United States. The company has a rich history, dating back several decades, of successfully identifying and developing oil and gas reserves in various regions. Crescent Energy Company operates in multiple basins across the United States, including the Permian Basin, Powder River Basin, and Eagle Ford Shale, among others.

Crescent Energy Company is a dynamic player in the energy sector, characterized by its commitment to innovation, sustainability, and community engagement, making it a key player in the oil and gas industry.

Introduction:

In today’s dynamic market environment, investors are constantly seeking promising opportunities to maximize their returns. One such area of interest is exploring the potential of Crescent Energy Company (CRGY). In this article, we delve into the opportunities presented by CRGY and how investors can capitalize on them.

Where are the Opportunities in CRGY

Identifying opportunities within Crescent Energy Company involves examining various aspects of its operations, market dynamics, and industry trends. Here are some key areas where opportunities may lie:

- Asset Optimization: Crescent Energy can explore opportunities to optimize its existing asset portfolio by enhancing production efficiency, implementing cost-saving measures, and maximizing the recovery of hydrocarbon reserves. This could involve leveraging advanced technologies, conducting reservoir studies, and implementing best practices in reservoir management.

- Strategic Acquisitions and Partnerships: Crescent Energy can capitalize on strategic acquisitions and partnerships to expand its footprint in key producing regions, gain access to high-potential assets, and diversify its asset base. This may involve acquiring producing properties, participating in joint ventures, or forming strategic alliances with other industry players.

- Exploration and Development: Crescent Energy can pursue opportunities for exploration and development in promising oil and gas basins with untapped potential. This could include conducting geological and geophysical studies, acquiring exploration licenses, and drilling exploratory wells to identify new reserves and prospects for future development.

- Technology Innovation: Embracing technological innovation presents opportunities for Crescent Energy to improve operational efficiency, reduce costs, and enhance recovery rates. This could involve adopting advanced drilling techniques, deploying enhanced oil recovery methods, and leveraging data analytics and machine learning technologies to optimize production and reservoir management.

- Energy Transition: Crescent Energy can explore opportunities to diversify its energy portfolio and transition towards cleaner and renewable energy sources. This could involve investing in renewable energy projects such as solar, wind, or geothermal energy, as well as exploring opportunities in carbon capture, utilization, and storage (CCUS) technologies.

- Economic and Regulatory Environment: Crescent Energy can leverage opportunities arising from favorable economic conditions, government incentives, and regulatory policies that support the growth of the oil and gas industry. This may include tax incentives for exploration and development, streamlined permitting processes, and policies promoting domestic energy production and infrastructure development.

- Market Expansion: Crescent Energy can explore opportunities to expand its market presence and customer base by targeting new geographical regions, niche markets, or emerging sectors within the energy industry. This could involve identifying underserved markets, diversifying product offerings, and developing innovative solutions to meet evolving customer needs and preferences.

- Sustainability and ESG Initiatives: Embracing sustainability and environmental, social, and governance (ESG) initiatives presents opportunities for Crescent Energy to enhance its reputation, attract socially responsible investors, and mitigate operational risks. This could involve implementing environmentally friendly practices, reducing greenhouse gas emissions, and promoting community engagement and stakeholder relations.

By identifying and capitalizing on these opportunities, Crescent Energy Company can position itself for sustainable growth, profitability, and long-term success in the dynamic and evolving energy industry landscape.

Understanding CRGY:

CRGY, plays a crucial role in various sectors. As an investor, understanding the underlying factors driving CRGY’s performance is essential for identifying potential opportunities.

What is (CRGY)?

Crescent Energy Company is an independent oil and gas company that operates primarily in the United States. It focuses on acquiring, developing, and operating oil and gas properties across various basins, including the Permian Basin, Powder River Basin, and Eagle Ford Shale. The company has a long-standing history of successfully identifying and developing oil and gas reserves, leveraging advanced drilling techniques and technology to maximize resource recovery and operational efficiency.

Crescent Energy Company is committed to sustainability and environmental stewardship, adhering to strict regulations and investing in initiatives to minimize its environmental footprint. Additionally, the company prioritizes community engagement and economic development in the regions where it operates. With a track record of strong financial performance and a focus on innovation, Crescent Energy Company is a prominent player in the energy sector, poised for continued growth and success.

Importance of (CRGY) in the Market:

The importance of (CRGY) in the market can vary depending on the specific context it represents. Generally, (CRGY) signifies a particular sector, industry, or market segment that holds significance for investors, traders, and analysts. Understanding the importance of (CRGY) involves recognizing its impact on various aspects of the market, such as:

- Investment Opportunities: (CRGY) may indicate sectors or industries with potential for growth and profitability, attracting investors seeking opportunities to generate returns on their investments.

- Market Trends: Tracking (CRGY) helps identify emerging trends and patterns within specific sectors, providing insights into market dynamics and investor sentiment.

- Economic Indicators: (CRGY) can serve as an economic indicator, reflecting broader economic trends and influencing market sentiment and investor confidence.

- Risk Management: Assessing the performance and outlook of (CRGY) enables investors and businesses to manage risks effectively by diversifying portfolios and making informed decisions.

- Policy Implications: Changes in government policies, regulations, or geopolitical events may impact (CRGY), highlighting its importance in understanding the broader market landscape.

- Sectoral Analysis: Analyzing (CRGY) facilitates sector-specific analysis, allowing investors to evaluate the performance of individual industries and make strategic investment decisions.

Overall, the importance of (CRGY) lies in its ability to provide valuable insights into market trends, investment opportunities, and economic conditions, helping market participants navigate the complexities of the financial landscape.

Historical Performance of (CRGY):

The historical performance of Crescent Energy Company reflects its evolution and achievements over time within the energy industry. To understand its trajectory, we can analyze key financial metrics, operational milestones, and market dynamics that have shaped its journey.

- Price Movements: Examining historical price data reveals the fluctuations and volatility experienced by (CRGY) over different time frames. This analysis helps identify patterns, trends, and potential support and resistance levels.

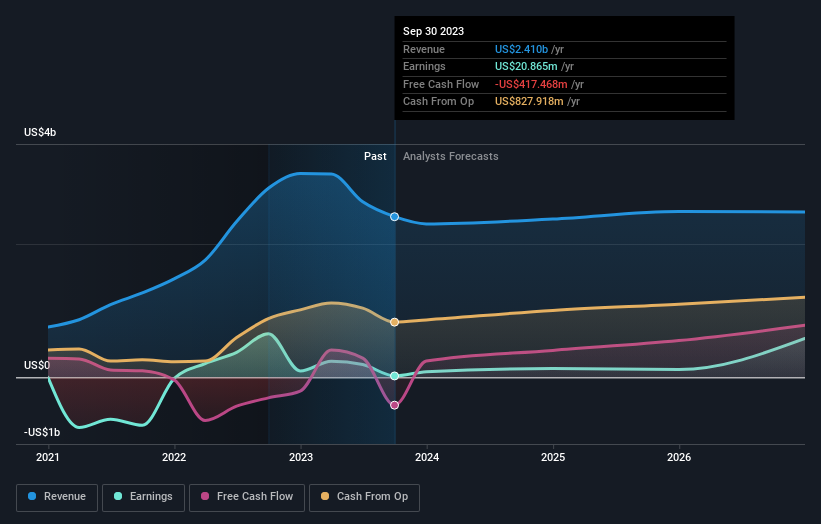

- Financial Metrics: Assessing historical financial metrics, such as revenue, earnings, profit margins, and cash flow, provides insights into the fundamental health and stability of (CRGY). This information helps evaluate the underlying strength and growth potential of the sector or industry represented by (CRGY).

- Market Sentiment: Historical performance data also reflects market sentiment and investor behavior towards (CRGY). Bullish or bearish trends, periods of accumulation or distribution, and shifts in investor sentiment can be identified by analyzing historical price and volume patterns.

- Comparative Analysis: Comparing the historical performance of (CRGY) to relevant benchmarks, such as market indices or peer sectors, helps assess its relative strength or weakness. This comparative analysis provides context and helps investors make informed investment decisions.

- Event Analysis: Historical performance data can be analyzed in conjunction with significant events, such as economic recessions, industry disruptions, regulatory changes, or company-specific news. Understanding how (CRGY) responded to past events can provide insights into its resilience and adaptability.

Overall, studying the historical performance of (CRGY) is essential for understanding its behavior, identifying patterns and trends, and making informed investment decisions based on past performance and future potential.

Current Trends and Market Dynamics:

Understanding the current trends and market dynamics of (CRGY) is crucial for investors, analysts, and stakeholders looking to navigate the market effectively. Here are some key insights into the current state of (CRGY) and its market dynamics:

- Sector Performance: Assessing the overall performance of the sector or industry represented by (CRGY) provides valuable context. Analyzing factors such as revenue growth, profitability, and market share helps gauge the sector’s health and prospects.

- Market Sentiment: Monitoring market sentiment towards (CRGY) is essential for understanding investor perception and behavior. Factors such as news, events, and macroeconomic conditions can influence sentiment and impact (CRGY)’s performance.

- Technological Advancements: (CRGY) may be influenced by technological advancements and innovations within its sector. Keeping abreast of emerging technologies, trends, and disruptions helps anticipate changes in market dynamics and competitive landscape.

- Regulatory Environment: Changes in regulations or government policies can significantly impact (CRGY)’s operations and performance. Monitoring regulatory developments and compliance requirements is essential for assessing risk and opportunity.

- Global Economic Factors: (CRGY) may be sensitive to broader economic trends and geopolitical events. Factors such as interest rates, inflation, trade policies, and currency fluctuations can affect (CRGY)’s performance in domestic and international markets.

- Consumer Behavior: Understanding consumer preferences, behavior, and demographics can provide insights into (CRGY)’s market potential and growth prospects. Analyzing consumer trends, spending patterns, and purchasing habits helps identify opportunities for (CRGY) within its target market.

- Competitive Landscape: Assessing (CRGY)’s competitors and their strategies is vital for identifying strengths, weaknesses, and opportunities. Understanding competitive dynamics, market positioning, and differentiation helps (CRGY) formulate effective strategies to gain a competitive edge.

- Investor Expectations: Managing investor expectations and communicating effectively with shareholders is essential for (CRGY)’s long-term success. Providing transparent and timely updates on financial performance, strategic initiatives, and future prospects helps build trust and confidence among investors.

By staying informed about these current trends and market dynamics, stakeholders can make well-informed decisions and capitalize on opportunities in (CRGY) and its respective market.

Future Growth Potential:

Assessing the future growth potential of (CRGY) involves analyzing various factors that could impact its performance and market outlook. Here are key considerations to evaluate the potential growth prospects of (CRGY):

- Market Demand: Understanding the demand for products or services offered by (CRGY) is essential. Factors such as demographic trends, consumer preferences, and market size influence demand and growth potential.

- Industry Trends: Analyzing industry trends and forecasts helps identify opportunities for growth. Emerging technologies, regulatory changes, and evolving consumer needs can shape industry dynamics and create growth opportunities for (CRGY).

- Innovation and Product Development: (CRGY)’s ability to innovate and develop new products or services can drive future growth. Investing in research and development, expanding product offerings, and adapting to changing market trends are essential for sustaining competitiveness and capturing market share.

- Expansion Strategies: Assessing (CRGY)’s expansion strategies, including geographical expansion, market penetration, and strategic partnerships, can provide insights into its growth trajectory. Identifying untapped markets and opportunities for expansion is crucial for maximizing growth potential.

- Financial Performance: Analyzing (CRGY)’s financial performance, including revenue growth, profitability, and cash flow generation, helps assess its ability to sustain growth. Strong financial fundamentals and effective cost management are indicative of future growth potential.

- Market Positioning: Evaluating (CRGY)’s market positioning and competitive advantages is essential. Understanding its unique value proposition, brand strength, and customer loyalty can help identify opportunities for market differentiation and growth.

- Macro-economic Factors: Considering macro-economic factors such as GDP growth, interest rates, and inflation rates provides context for (CRGY)’s growth potential. A favorable economic environment and conducive market conditions can support business expansion and growth initiatives.

- Regulatory Environment: Assessing regulatory trends and compliance requirements is crucial for anticipating potential challenges and opportunities. Adapting to regulatory changes and maintaining compliance is essential for sustainable growth in regulated industries.

By evaluating these factors and trends, stakeholders can better understand the future growth potential of (CRGY) and make informed decisions regarding investment, expansion, and strategic planning.

Technological Advancements:

Technological advancements play a crucial role in shaping the growth trajectory of (CRGY) and influencing its future prospects. Here’s how technological innovations can impact (CRGY) and create opportunities for growth:

- Automation and Efficiency: Integration of advanced technologies such as artificial intelligence (AI), machine learning, and robotic process automation (RPA) can enhance operational efficiency and streamline processes within (CRGY). Automated systems can optimize resource allocation, reduce manual errors, and improve overall productivity, leading to cost savings and increased profitability.

- Data Analytics and Insights: Leveraging big data analytics and predictive analytics tools enables (CRGY) to extract valuable insights from large volumes of data. By analyzing customer behavior, market trends, and industry dynamics, (CRGY) can make data-driven decisions, identify growth opportunities, and tailor products or services to meet customer needs more effectively.

- Digital Transformation: Embracing digital transformation initiatives allows (CRGY) to modernize its operations, enhance customer experience, and stay competitive in the digital age. Implementing digital channels, such as mobile apps, online platforms, and e-commerce solutions, enables (CRGY) to reach a wider audience, offer personalized services, and drive customer engagement.

- Cybersecurity Measures: As (CRGY) adopts digital technologies, cybersecurity becomes paramount to protect sensitive information and safeguard against cyber threats. Investing in robust cybersecurity measures, such as encryption, multi-factor authentication, and threat detection systems, ensures data security and maintains customer trust, fostering long-term growth and sustainability.

- Blockchain and Cryptocurrency: Exploring opportunities in blockchain technology and cryptocurrency can open up new avenues for (CRGY). Blockchain technology offers secure and transparent transaction processing, while cryptocurrency adoption facilitates faster and more cost-effective cross-border transactions, reducing friction in financial transactions and expanding (CRGY)’s market reach.

- Innovative Products and Services: Incorporating technological innovations into product development enables (CRGY) to launch innovative products and services that meet evolving customer demands. Whether it’s introducing mobile banking features, contactless payment solutions, or personalized financial advisory services, (CRGY) can differentiate itself in the market and attract new customers.

- Collaboration with Fintech Startups: Partnering with fintech startups and technology providers allows (CRGY) to leverage external expertise and accelerate innovation. Collaborative efforts can lead to the development of disruptive solutions, such as peer-to-peer lending platforms, robo-advisors, or digital wallets, enhancing (CRGY)’s competitive position and market relevance.

In summary, embracing technological advancements presents (CRGY) with significant opportunities for growth, innovation, and competitive advantage. By harnessing the power of technology, (CRGY) can transform its operations, enhance customer experiences, and capitalize on emerging trends, positioning itself for long-term success in the dynamic financial services industry.

Sector-wise Opportunities in (CRGY):

Identifying sector-wise opportunities in (CRGY) involves analyzing the various industries and sectors where (CRGY) has the potential to thrive and grow. By understanding the market dynamics, trends, and growth prospects within different sectors, investors can pinpoint areas of opportunity for (CRGY) and make informed investment decisions. Here are some key sectors where opportunities may exist for (CRGY):

- Renewable Energy: (CRGY) may find significant opportunities in the renewable energy sector, including solar, wind, hydroelectric, and geothermal power generation. With increasing global focus on sustainability and environmental conservation, there is growing demand for clean energy solutions, presenting ample opportunities for (CRGY) to expand its presence.

- Technology: The technology sector offers numerous opportunities for innovation and growth, and (CRGY) may leverage its expertise in this area to develop innovative solutions and products. Areas such as artificial intelligence, cybersecurity, cloud computing, and digital transformation present promising opportunities for (CRGY) to capitalize on emerging trends and technological advancements.

- Healthcare: The healthcare sector is undergoing rapid transformation, driven by factors such as demographic shifts, advances in medical technology, and changing consumer preferences. (CRGY) may explore opportunities in healthcare IT, telemedicine, medical devices, and pharmaceuticals to address evolving healthcare needs and enhance patient care.

- Infrastructure: Infrastructure development is critical for economic growth and sustainability, and (CRGY) may participate in infrastructure projects related to transportation, utilities, and urban development. Opportunities may exist in areas such as smart cities, transportation networks, renewable infrastructure, and sustainable construction.

- Financial Services: The financial services sector presents opportunities for (CRGY) to provide innovative fintech solutions, banking services, and financial products. With the increasing digitization of financial services and growing demand for online banking and payment solutions, (CRGY) can explore opportunities to partner with financial institutions and disrupt traditional banking models.

- E-commerce and Retail: The e-commerce and retail sector continues to experience robust growth, driven by changing consumer behavior and preferences. (CRGY) may explore opportunities in e-commerce platforms, supply chain logistics, last-mile delivery solutions, and digital marketing to capitalize on the growth of online retail and consumer spending.

- Telecommunications: The telecommunications sector plays a crucial role in connecting people and businesses globally, and (CRGY) may explore opportunities in telecommunications infrastructure, 5G networks, satellite communications, and Internet of Things (IoT) technology to support digital connectivity and communication needs.

By identifying sector-wise opportunities in (CRGY), investors can diversify their portfolios, mitigate risks, and capitalize on emerging trends and growth prospects across different industries. It’s essential to conduct thorough research and analysis to assess the potential risks and rewards associated with investing in specific sectors and industries.

Conclusion

As (CRGY) continues to evolve and innovate, the opportunities for investors are abundant. By staying informed, adopting sound investment strategies, and navigating the market with diligence, investors can unlock the full potential of (CRGY) and capitalize on lucrative investment prospects.